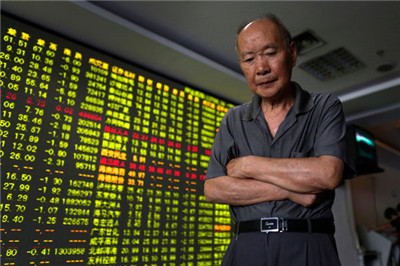

After several weeks of relative calm, tumult returned to China’s stock markets on Monday, casting new doubt on the government’s measures to support share prices.

经过几周的相对平静之后,动荡在周一重返中国股市,让人对政府的救市措施产生新的疑问。

The main Shanghai share index plunged 8.5 percent on Monday, its steepest one-day drop in eight years, while Shenzhen’s main index fell 7 percent.

主要的上海股市指数周一大跌8.5%,是八年来最大的单日跌幅,而深圳股市指数则下跌了7%。

“The return of debacle!” China’s official Xinhua news agency tweeted Monday on its verified account, noting that in the sell-off, about two-thirds of all mainland-listed stocks fell by the daily limit of 10 percent.

中国官方媒体新华社周一在其经过认证的Twitter帐号上发帖大呼“崩溃再现!”,并指出,在抛售中,所有在内地上市的公司,大约有三分之二的股票暴跌超过每天10%的下限。

The downturn ended a modest rally that started three weeks ago. The recovery had been engineered by direct and indirect intervention by the government to arrest a slide in the markets. Starting in June, shares lost more than $3 trillion worth of market value in a matter of weeks.

周一的暴跌结束了股市三周前开始的温和反弹。反弹是政府为了阻止股市跌落而直接和间接干预造成的。自6月份以来,股市已在几周内失去了相当于逾3万亿美元的市值。

Those support measures, which included a new $120 billion stock market stabilization fund backed by the central bank, a suspension of new share offerings and a six-month moratorium on big shareholders selling their stock, had partly restored investors’ confidence. As of Friday, those moves had helped lift the Shanghai index by 16 percent from its low on July 8.

政府的救市措施包括,成立新的由中央银行支持的1200亿元的股市稳定基金,暂停发行新股,禁止大股东在六个月内出售股票,这些措施已部分恢复了投资者的信心。截至上周五,这些措施帮助上证指数从其7月8日的低谷上升了16%。

Coming on the back of such state support, the dive on Monday was most likely to further unsettle investors. It also has broader economic ramifications for China, as the bull market in stocks in recent months had helped offset the slowdown in China’s traditional industrial drivers of growth. Despite the recent volatility, Shanghai’s main share index closed on Monday more than 70 percent higher than its level a year ago.

在国家的这些支持措施背景下,周一的股市跳水很有可能会进一步动摇投资者的信心。这对中国来说,还有更广泛的经济影响,因为近几个月的股票牛市曾帮助抵消由传统产业驱动的中国经济增长的放缓。尽管有这些近期的波动,但上海的主要股票指数周一收盘时,仍比一年前高出逾70%。

But the calm that had settled on the markets in recent weeks appears to have been fleeting. Part of the problem is the gigantic amount of borrowed money at play; investors in China took out huge amounts of loans from brokerage firms in recent months to invest in stocks. With share prices falling, the pressure will rise for investors to unwind some of these so-called margin trades to repay what they borrowed.

但股市最近几周的趋稳看来已转瞬即逝。问题的部分原因是股市中的巨额借贷;中国投资者在最近几个月里从证券公司得到巨额贷款,用来购买股票。随着股票价格的下跌,投资者面临着巨大压力,他们需要抛售一些这类靠所谓的融资交易卖下的股票,以偿还他们借来的钱。

The government could act further to support prices if the decline continues, for example, by pumping more money into the market, either directly or indirectly, and officials have recently signaled their willingness to continue stabilization measures.

如果股市继续下跌,政府可能会进一步采取支撑股价的行动,比如,直接或间接地将更多资金注入股市,官员最近也表示愿意继续采取稳定股市的措施。

Last week, the China Securities Regulatory Commission issued a denial of a report in Caijing, a respected Chinese financial news outlet, which had said the regulator was considering how to begin removing its supports for share prices.

上周,中国证券监督管理委员会否认了《财经》杂志的一篇报道,《财经》是一家受人尊敬的中国金融新闻媒体,其报道称,证监会正在研究如何推出救市措施的方案。

In a July 20 statement denying the report, Zhang Xiaojun, a spokesman for the regulator, said: “The commission will continue to stabilize the market and provide reassurance, and will use all its resources working towards the goal of preventing systemic risk.”

证监会新闻发言人张晓军在7月20日的一份声明中否认了上述报道,他说,“证监会将继续把稳定市场、稳定人心、防范系统性风险作为工作目标,全力做好相关工作。”

Caijing promptly removed the article from its website.

《财经》迅速将该报道从其网站上删除。