Australia's Treasury Wine Estates Ltd. is planning to open wine bars or restaurant and entertainment outlets in China in a bid to get the country's consumers drinking luxury wines -- not just giving them as gifts.

澳大利亚葡萄酒厂商Treasury Wine Estates Ltd.目前打算在中国开酒廊或餐馆及休闲场所,试图借此让该国的消费者们开始自己享用高端葡萄酒,而不只是把这些葡萄酒当做礼物送给别人。

The winemaker intends to unveil its own wine outlets in the next three to five years, said David Dearie, Treasury's chief executive. The goal is to help consumers learn more about wine and drink more of it, said Mr. Dearie, noting that it is too early to disclose details. Currently it sells in China only through distributors.

这家葡萄酒厂商的首席执行长迪尔里(David Dearie)说,公司打算在未来三到五年时间里推出自己的酒廊。他说,目的是帮助消费者对葡萄酒有更多了解,增加他们对葡萄酒的消费。迪尔里说,现在透露细节还为时过早。该公司目前仅通过分销商在中国内地出售产品。

'If you're going to make great wine and be a leading brand in China, you also have to be consumer-oriented,' Mr. Dearie said.

迪尔里说,如果要生产很棒的葡萄酒并且成为中国国内的领先品牌,就必须以消费者为导向。

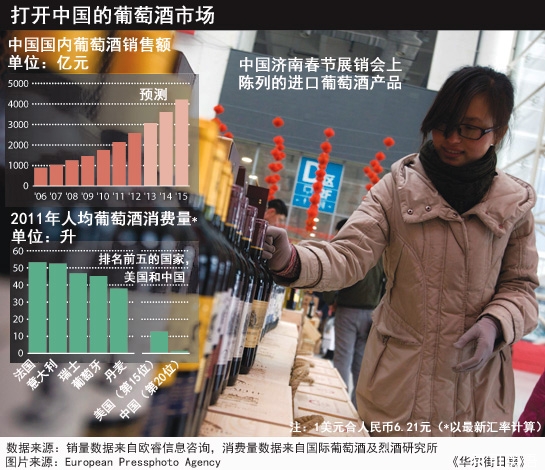

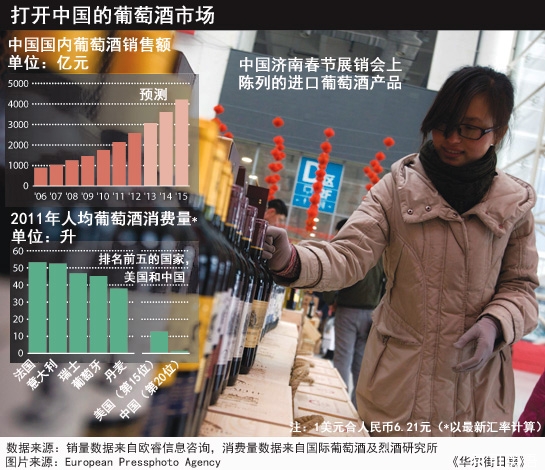

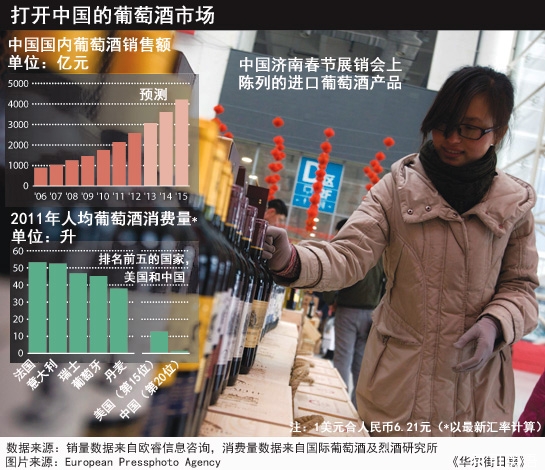

China's wine market has exploded in recent years, spurring major competition among winemakers who have flooded the market and are now looking to differentiate themselves. Sales of wine reached 257 billion yuan, roughly $41 billion, in 2012, up 20% from a year earlier, according to research firm Euromonitor International.

中国葡萄酒市场近年来迅猛发展,促使涌入中国市场的葡萄酒商展开了激烈竞争,现在它们着眼于要突出自己的与众不同。据研究机构欧睿信息咨询(Euromonitor International)统计,2012年中国市场的葡萄酒销售额达到了410亿美元(合人民币2,570亿元),较上一年增长了20%。

But wine consumption per capita in China is still a fraction of that in other countries. Chinese drinkers consumed only 1.4 liters of wine per person in 2011, far below the French average of 53.2 liters per person, according to the most recent data from London-based research company International Wine & Spirit Research. It predicts China's per-capita consumption will increase to 2.1 liters per person over the next three years.

但相比其它国家,中国人均葡萄酒消费仍微不足道。位于伦敦的国际葡萄酒及烈酒研究所(International Wine & Spirit Research)的最新数据显示,2011年中国饮酒者人均葡萄酒消费量仅为1.4升,远低于法国人均53.2升的消费量。该机构预计,未来三年中国人均葡萄酒消费量将增至2.1升。

Mr. Dearie said higher-quality import wines are often given as gifts between businessmen to be stashed away rather than swilled. And while Treasury is rolling out some of its priciest wines to be used as gifts, the company hopes that with wine bars or restaurants it will encourage actual consumption of the wine.

迪尔里说,高品质的进口葡萄酒常被商人作为礼物互送,然后人们将其束之高阁,而不是真正拿来品尝。就在Treasury即将推出一些最昂贵的葡萄酒用于送礼时,该公司也希望通过开设酒廊或餐馆来鼓励中国消费者真正体会葡萄酒的芬芳。

Mr. Dearie said the move toward entertaining hasn't been influenced by China's recent austerity campaign, in which catering and wine companies have been hurt by a ban on government banquets.

迪尔里说,上述让人们进一步接受葡萄酒的举措并没有受到中国近来节俭风的影响。此前,一道禁止政府举办奢华宴请的命令对餐饮企业和葡萄酒厂商产生了一定冲击。

Local vineyards and wine retailers have already started opening bars, restaurants, clubs and shops with the option to drink on premises, like state-owned Cofco Corp.'s Chateau Junding wine-club chain. Aussino World Wines, a Chinese wine retailer with shops in more than 100 cities in China, runs lounges in China's southern city of Guangzhou.

中国本土的葡萄园和葡萄酒零售商已经开始开设酒吧、餐馆、俱乐部和专卖店,消费者可在其中品尝葡萄酒,如国企中粮集团(Cofco Corp.)旗下的连锁葡萄酒俱乐部中粮君顶酒庄(Chateau Junding)。中国葡萄酒零售商富隆酒业(Aussino World Wines)在国内100多个城市有专卖店,在广州有多个会所。

Executives of liquor giant Diageo PLC, which recently launched its second flagship bar in China, say its Johnnie Walker Houses have been successful in helping Diageo identify its VIP consumers and to sell exclusive products that can boost the brand and its profit.

酒业巨头帝亚吉欧(Diageo PLC)的高管说,其“尊尼获加尊邸”(Johnnie Walker Houses)已成功帮助该公司甄别出了VIP消费者,并且有助于那些可彰显其品牌和增加利润的独家产品的销售。该公司前不久在中国推出了第二个旗舰酒吧。

Fongyee Walker, a Beijing-based wine consultant, said winemakers have to be creative in China, adapting to local habits. 'People in the West buy to consume at home; in China, they buy to consume with friends when they're out,' Ms. Walker said.

常驻北京的葡萄酒顾问赵凤仪(Fongyee Walker)说,葡萄酒厂商必须在中国市场上有创意,要适应中国消费者的习惯。她说,西方人会买酒在家喝,而中国人则是与朋友在外面吃饭时点酒来喝。

Mr. Dearie said Treasury -- which sells in China wines such as a high-end Penfolds Grange for around 7,594 yuan, or about $1,222, and a low-end Rosemount Diamond Label for 160 yuan -- is working with one of its distributors toward opening a 6,000-square-meter wine gallery, for tasting events, in Shanghai.

迪尔里说,Treasury目前正与其中一家经销商合作,希望在上海开一个面积达6,000平方米的酒廊,用于举办品酒活动。该公司在中国国内销售的葡萄酒中,既有售价约人民币7,594元(约1,222美元)的奔富葛兰许(Penfolds Grange)等高端酒,也有售价人民币160元的玫瑰山庄钻石酒标(Rosemount Diamond Label)系列的低端酒。

He said he has no plans to develop special blends to suit China's flavorful food, which doesn't adhere well to the traditional pairings dictating, for example, that red wine goes with beef.

迪尔里说,目前自己并没有为适应中国美食研发特别调味酒的打算。中餐不是很符合传统上红酒配牛肉这样的搭配原则。

Treasury, spun off from Foster's Group Ltd. in 2011, is investing 15 million Australian dollars (US$15.7 million) in its Australian-based winery Magill Estate, in part to attract Asian visitors, Mr. Dearie said. He said they are working with tourism boards and are boosting infrastructure so that Asian tourists can store wine there or ship wine from the Magill Estate.

迪尔里说,Treasury将对旗下位于澳大利亚的葡萄酒厂Magill Estate投资1,500万澳元,投资的目的之一是吸引亚洲参观者。他说,该公司现在正与旅游机构合作,大力发展基础设施,这样亚洲游客就可在那里储藏葡萄酒,也可将Magill Estate出产的葡萄酒发至外地。Treasury是在2011年从Foster's Group Ltd.分拆出来的。

The company is also increasing its presence at duty-free shops around the world and holding tastings there so Asian tourists can learn more about premium brands like its 1,874 yuan Wolf Blass Platinum Label, he said.

迪尔里说,Treasury还在全球各地的免税店提高自己的“能见度”,举办品酒会,这样亚洲游客就可对售价人民币1,847元的禾富酒庄白金(Wolf Blass Platinum Label)系列等高端品牌有更多了解。

Treasury's sales by volume to China and Hong Kong rose 31% in the fiscal year ended June 30, 2012 from a year earlier.

在截止2012年6月30日的财年,Treasury在中国内地和香港的销量同比增加了31%。

Mr. Dearie said Treasury's business in China is profitable. He declined to offer further details.

迪尔里说,Treasury在中国的业务是赚钱的。他拒绝透露更多细节。

Treasury's net profit increased 31% to A$52.3 million in its fiscal first half ended Dec. 31 on a reported-currency basis.

Treasury财报显示,在截至去年12月31日的上半财年,Treasury净利润增加了31%,至5,230万澳元。