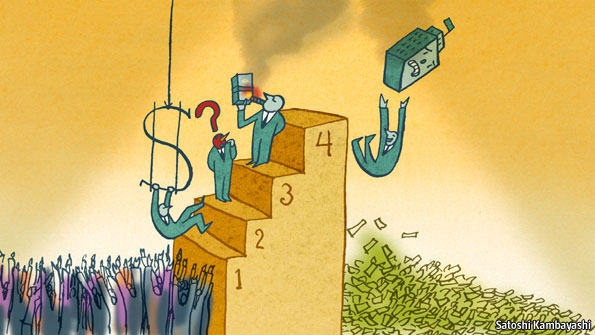

The golden rules of banking

银行业的赚钱黄金法则

They make the rules, and get the gold

游戏规则的掌握者,金融市场的获利人

THE crisis has taught people a lot about the banking industry and the thought processes of its leaders. These lessons can be distilled into four golden rules.

人们从这次的金融危机中学会了很多银行业的知识,还有其领导者的思维模式。这些知识能被归纳为以下四个黄金法则:

1. The laws of supply and demand do not apply. When food producers compete to supply a supermarket, the retailer has the luxury of selecting the lowest bidder. But when it comes to investment banking, wages are very high even though the number of applicants is vastly greater than the number of posts. If the same was true of, say, hospital cleaning, wages would be slashed.

1、供给与需求法则行不通。食品市场中,当食品生产者为了给超市供应货源而竞争时,零售商们就处于买方市场(能选择最低出价者)。但在投资银行市场中,哪怕应聘者远远多于招聘人,他们的工资还是高的离谱。如果同样的情况在其他行业发生,比如医院招聘清洁工,那么应聘者的工资就会被大大削减。

An investment bank, like a supermarket, demands a certain quality standard: it will not hire just anybody. But whereas it may be easy to identify a rotten banana, it is harder to be sure which trainee will be the next Nick Leeson and which the potential George Soros. That gives executives an excuse when things go wrong.

一个投行就如同一个超市,需要一定的质量标准。它不会随随便便聘用人。认出一个害群之马也许很简单,但要确认哪一个实习生会铸成大错成为下一个尼克 李森,又有哪一个实习生会成为下一个乔治 索罗斯无疑是很困难的。(这两个人不认识的自己百度一下)这也给了投行高管们以犯错误的借口。

2. Success is down to my genius; failure is caused by someone else. When banks do well, and profits soar, the bosses are responsible for it all with their strategic cunning and inspiring leadership. Huge bonuses are therefore due.

2、成也在我,败也在他。(不通顺)银行业搞得风生水起、利润激增的时候,老板们的战略决策能力和鼓舞人心的领导能力就成了大功臣。他们也因此拿了很多奖金。

But, like Macavity the mystery cat, executives were never at the scene of the crime. They did not attend the crucial meeting, read the vital memo or open the incriminating e-mail. Together with this surprising inattentiveness, executives have a remarkably faulty memory which means that conversations are rarely recalled in any detail. It is a wonder, indeed, given their technical shortcomings and early-onset Alzheimer’s, that they make it to the top of their organisations at all.

但是和隐藏的魔爪——麦卡维提一样(详见音乐剧《猫》),终极Boss们永远都不会出现在犯罪现场。他们不参加重要会议,阅读重要的备忘录,或者打开可能会牵连自己的邮件。不仅这种不专心(对企业不上心)令人震惊,高管们的记性也出奇的烂,他们往往都记不住谈话的细节。在这种技术Bug和提早老年痴呆的情况下,他们能成为高管简直是奇迹。

But executives do tend to remember one vital fact. When scandal breaks, the blame should lie with a few rogue employees who have ignored the corporate culture. Managers cannot possibly be expected to keep track of the actions of junior staff. And that leads to the next rule.

但是高管们对一个重要的事实还是记得住的。当丑闻曝光之时,被骂的永远是那些忽视了企业文化的“流氓”员工。经理们不可能时时刻刻盯着基层员工,这个也是下一个黄金法则的铺垫。

3. What is lucky for an individual trader may be unlucky for the bank as a whole. There is a survivorship bias in both fund management and trading. If your career starts with some bad losses, it will quickly come to an end. So, by definition, veteran traders will have had initial success. But that could be down to luck, not skill.

3、个体获利,集体遭殃。在投资管理和证券交易市场中都存在一个生存法则:如果你的事业以损失为开端,它很快就会终结。所以,由此可见,那些在交易战场上经受过战火洗礼的老兵们,最开始肯定都取得了成功。但是这个成功很可能是因为运气,而不是实力决定的。

Successful fund managers attract more clients and thus manage more money. This will keep happening until they have a bad year, when clients will desert them. Their worst result will thus occur when they have the most money to look after. They may end up losing more client money in cash terms than they ever made.

成功的基金经理能够吸引更多的客户因此就能控制更多的钱。这种情况直到经济衰退、客户抛弃他们之前都会一直持续。最坏的结果总是在他们敛到最多钱财的时候发生,最终以亏得血本无归告终。

Similarly, successful traders will be given more responsibility, first heading their departments and then leading the bank itself. They will gain a reputation as the kind of person who can handle risk, and they will believe their own publicity. The likes of Dick Fuld of Lehman Brothers and Jon Corzine at MF Global seemed to regard caution as a quality for wimps.

相似地,成功的证券交易人也肩负着更大的责任,有责任先富部门再富银行。他们会因此获得“风险应对专家”的美称,也会因此对自己越发“自信”。例如雷曼兄弟的迪克 福尔德和全球曼氏金融的科尔辛,他们都将“入市有风险,投资须谨慎”视若耳旁风。

This is a variant of the Peter principle, which holds that managers get promoted to their level of incompetence. The trader-cum-executive will make the biggest mistake when he is in charge of the whole bank. By this stage, he will be personally rich and will remain so even if the entire bank fails, not least because:

经理们往往都会被提拔到他们无法胜任的位置,这是彼得原理的又一个变形体。如果一个证券交易人同时又作为高层管理者掌管整个银行,那么悲剧就发生了。到了这个阶段他自己会很富有,而且如果银行垮了,他会一直富有下去,原因尤其在于:

4. Resigning can be a retirement plan. When ordinary folk resign, they are lucky to get paid to the end of the month. But when bankers leave in awkward circumstances, they make out like a lottery winner (Bob Diamond, formerly of Barclays, has done worse on this score than others). The bank may want to avoid a lawsuit, with all its unfavourable publicity. The more trouble the bank is in, the less publicity it will want and the better the negotiating position of the executive. This may not be the ideal incentive structure.

4、辞职也许就是为了养老。平民们辞职之后,月底能够拿到养老金就很不错了。但是当银行家们拍拍手抛下一堆烂摊子时,他们却赢得盆满钵满。(先前就职于巴克莱银行的鲍勃 戴蒙德是个例外,这货龊爆了。)这时候的银行也许是想避免官司和一切对其不利的言论。银行越深陷泥沼,越想在公众的视线中遁走,高官们越想争取有利的谈判地位。而这个似乎并不应该作为理想的激励机制。

Moreover, if the bank is big enough, the government will not be willing to let it fail. Take the Royal Bank of Scotland. Had it gone bankrupt, then the pension scheme might have fallen into the hands of the Pension Protection Fund (PPF), a collective-insurance plan. That would have been bad news for Fred Goodwin, the then chief executive, since individual pension payouts are capped under PPF rules. The limit at the time was £24,000 ($44,500) rather than the £703,000 he originally claimed.

而且如果银行规模够大,政府更不乐意让它就这么垮了。比如苏格兰皇家银行。其一旦破产,退休金计划将会被养老金保障基金收入囊中,这是一个集体保险计划。这对行政长官弗雷德 古德温来说应该是个坏消息。因为个人退休金的发放由养老金保障基金掌控,而当时实际发放量是两万四千英镑(约合四万四千五百美元)而不是他起初宣布的七十万零三千英镑。

Bankers get such generous payoffs because it is in their contracts and airtight contracts are needed to attract the best people. But is this right? The BBC just appointed a director-general on a salary that is one-third less than that of the previous incumbent. Even so, there was no shortage of qualified applicants for the post. Back to the first rule: in banking, the laws of supply and demand do not apply.

银行家们都能够拿到可观的薪水,这是劳务合同上面注明了的。要想吸引最好的人才,这种完美诱人的合同是必须的。但这是对的吗?BBC刚刚指出一个总干事现在拿的工资比先前少了三分之一。即使如此,合格的岗位申请却一直都不见减少。让我们回顾一下第一个黄金法则:在银行业,需求与供给法则从来都行不通。