The price of safety

安全的代价

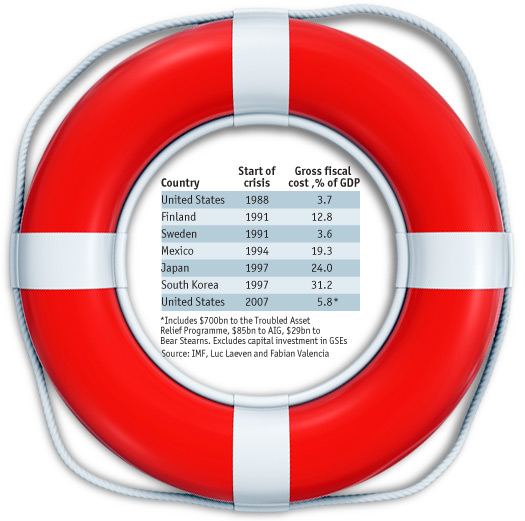

How much have previous bail-outs cost?

以前的救市计划花费多少?

CONGRESS is under pressure to approve the Treasury’s proposed $700 billion rescue package. Lawmakers, however, are conscious of the cost to the taxpayer: together with loans to AIG and Bear Stearns, public backing so far approaches 6% of GDP. This is well above the 3.7% of GDP of the savings-and-loan bail-out in the late 1980s and early 1990s. But some 6% of GDP is still much less than the average cost of resolving banking crises around the world in the past three decades, which a study by Luc Laeven and Fabian Valencia, of the IMF, puts at 16%.

目前国会正面临压力,要求它通过财政部提出的7000亿美元的救市计划。不过,立法者们意识到了纳税人需要承担的代价:算上提供给AIG和贝尔斯登的贷 款,目前此次金融危机中的公共支出已经接近GDP的6%。而1980年代末和1990年代初发生储蓄信贷机构危机时,这一数字不过为3.7%。但是,根据 国际货币基金组织Luc Laeven 和 Fabian Valencia的一项研究,过去三十年来世界为解决银行危机的公共支出占GDP的份额平均为16%。6%仍远低于这一平均值。